These Cars Still Qualify for the Existing EV Tax Credit

You may need to act fast if you want to buy one of these EVs.

Volkswagen

Volkswagen

On August 16, 2022, President Joe Biden signed the Inflation Reduction Act, which amended the Clean Vehicle Credit for electrified vehicle purchase tax credits in the United States. This new credit doesn't go into effect until January 1, 2023. However, it stopped the previous tax credits for vehicles produced outside North America from the moment the president signed the bill.

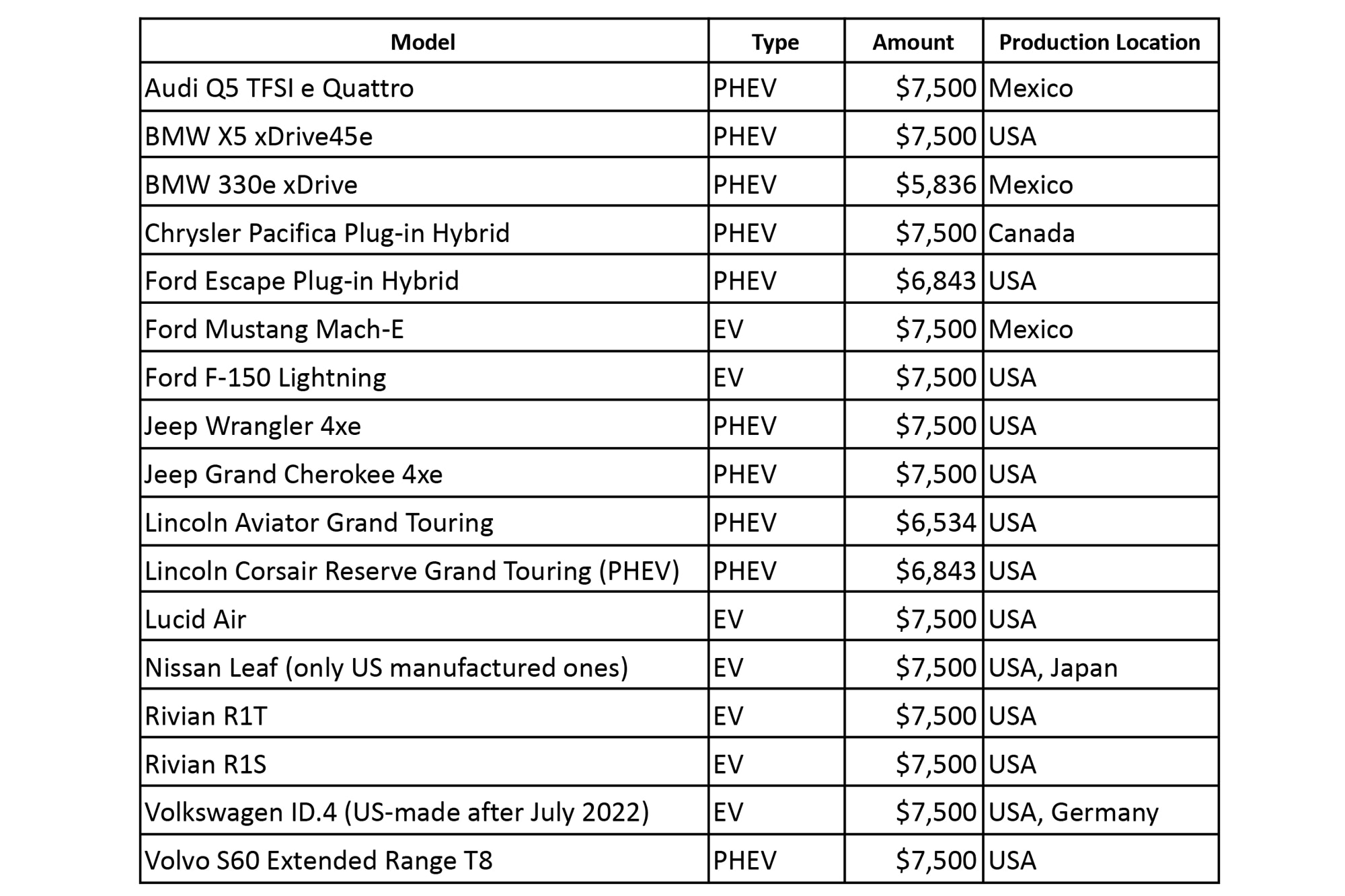

The Department of Energy provided a list of plug-in vehicles produced in North America. Here is the complete list of vehicles eligible for the tax credit for purchase between Aug. 17 and Dec. 31.

There are a few things to be aware of:

First, since General Motors and Tesla met the capacity limit (200,000 units per company) under the old plan well before the signing of the bill, those companies’ models are not eligible for the tax credit. However, many vehicles from those manufacturers may be eligible for the tax credit beginning Jan 1, 2023.

Second, vehicles with multiple origins like the Nissan Leaf and Volkswagen ID.4 need to be checked by looking at the window sticker for the place of final assembly, or by using the

Lastly, this is a tax credit, not an immediate discount at the point of the purchase. To receive the full amount of the tax credit, the purchaser must have more than the credit amount in tax liabilities. If the purchaser doesn’t have enough tax liabilities after the deduction, they will only receive the rest of the tax liability in the form of a refund, when they file their yearly federal income taxes.

States, local municipalities, and companies (usually utility companies but sometimes an employer) offer rebate/incentive programs. Vehicles might be eligible for those regardless of the status of this tax credit.

Written by humans.

Edited by humans.

Mel Yu

Mel YuMel is from the Gangnam district of Seoul, South Korea, and he first came to the U.S. to study mechanical engineering. Since 2000, he has worked in various auto-industry fields, ranging from new-car dealers to consulting major automakers. In his free time, he flies a Piper aircraft and hunts for automotive unicorns.

Related articles

View more related articles